ESS Certificate Calculator

Changes will be deployed to all NSW ESS customers this week to comply with the new ESS rule commencing June 19th.

Certificate Calculation Updates

- Updates to HWS, RDC, and Pool Pump activities.

- Addition of co-payments for HWS and Air Con activities.

- Updates to BCA Zones.

Calculator Changes for HWS and RDC Activities.

- Implemented the new rule’s changes to HEER HWS abatements, now based on AS/NZS 4234 Climate Zones.

- Jobs completed in colder climate zones are rewarded with more certificates, while installations in warmer zones see a reduction.

Example:

- Activity D17 upgrade with a single system:

- Current: 46.97

- New HP-3AU: 30.50

- New HP5-AU: 33.31

- Activity F1.1 has been suspended to prevent accidental submissions. The calculator will zero down the ESC certificates for jobs done after the rule change.

- For RDC Activity F1.2, the lifetime on product classes 7, 8, and 11 is fixed to 8 years, removing the benefit from a larger display area.

These new rules apply to appointments scheduled on or after June 19th.

BCA Zones Changes

The ESS rule has updated the BCA Climate Zone rule to use BCA Zones published by the ABCB (Australian Building Code Board) found on the ABCB website and will no longer reference a BCA Zone table published in the ESS Rule. Postcode/suburb lists in Dataforce have been updated to comply with the new zones. Zones that have changed are named as BCA Climate Zone 6 (Prior Zone 5) or BCA Climate Zone 6 (Prior Zone 8). If the zones are identical, they remain with names such as BCA Climate Zone 6.

Changes to HEER Pool Pumps

- New installations allowed for this activity, with new questions qualifying the type of installation.

- Adjusted method to calculate certificates to provide increased rebates.

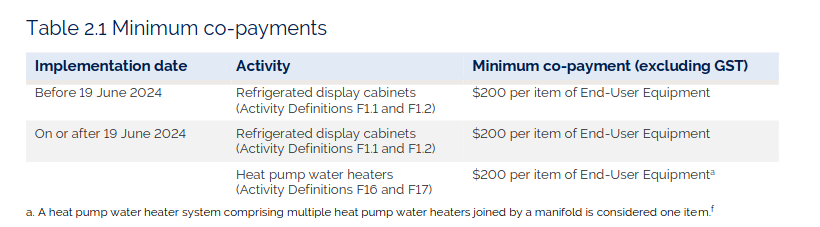

- Required co-payment of $200 per pump added.

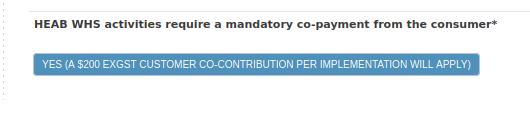

New Co-payments

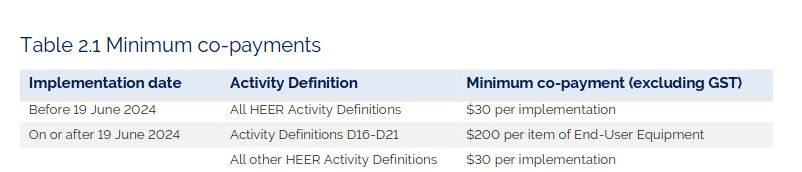

The following co-payments are mandated by the new rule:

- Activities D16-D21: $200.00 per end-user equipment/implementation.

- Activity D5: $200.00 per end-user equipment/implementation.

- Activities F16 and F17: $200.00 per end-user equipment/implementation (Systems installed in manifold configuration are considered one end-user equipment/implementation).

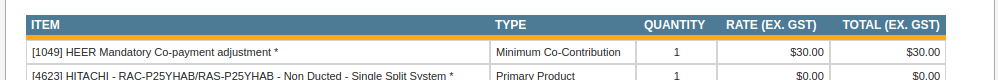

- To ensure the customer is charged the minimum, new co-payment products are added through additional questions.

Outlined new questions on this announcements page and encourage reading over them now.

Co-payment products auto-adjust their cost to ensure customers pay the minimum on their Quote/Invoice. Refer to help page with illustrated examples

These questions will be available prior to the changeover date of June 19th.

Co-payments Implementation Guide.

To ensure you are charging the customer the minimum required co-payment, we have added new co-payment products which will be linked via additional questions.

Co-Payment products auto-adjust their cost to ensure customers pays the minimum on their Quote/Invoice and we’ve written a help page with illustrated examples to help you understand the process.

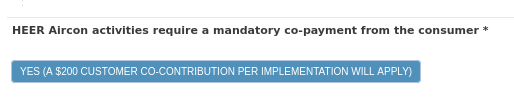

HEER AirCon Installations

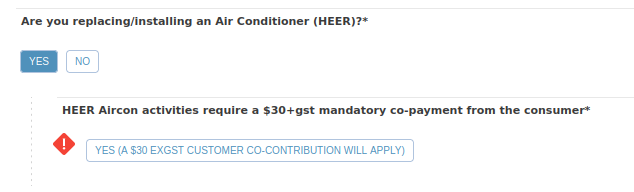

When the HEER method is selected and the job has activity date prior to the 19th June 2024 the above question will be shown and when answered will include 30 excGST contribution.

For appointments with an activity date after the 19th June a ‘Co-Payment Per Product’ question shown below will appear in Air Conditioner Question Block.

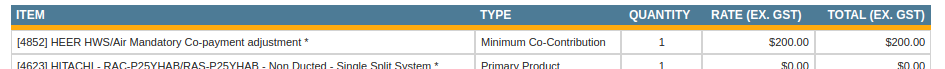

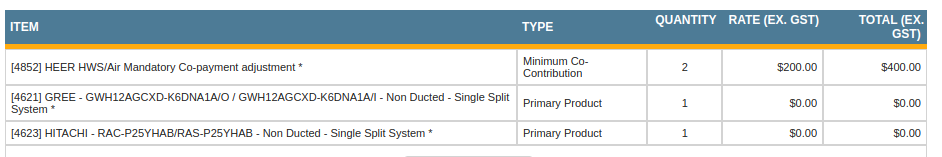

It has one answer that will attach a ‘HEER HWS/Air Mandatory Co-payment adjustment’ product having a $200+GST minimum co-payment amount.

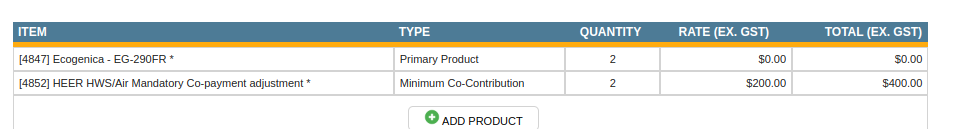

If 2 Blocks/2 Air Conditioners in a job we have 2 co-payments for subtotal of $400+GST

HEAB AirCon Installations

The HEAB Activities, such as F4, do not have a minimum required co-payment as of this rule change.

HEER HWS Installations

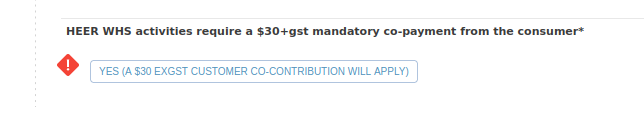

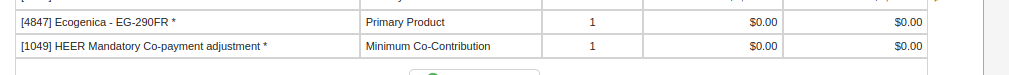

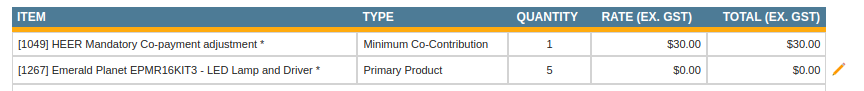

Prior to this rule change a $30+GST contribution was required.

Jobs with activity date prior to the 19th June will have the question shown above which links a ‘HEER Mandatory Co-payment adjustment’ $30+GST co-payment.

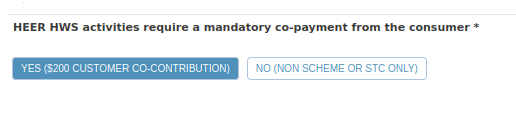

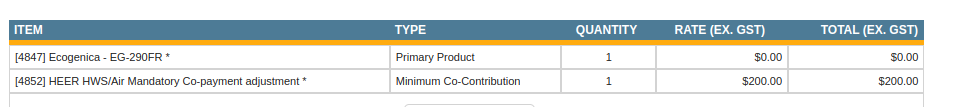

Jobs on/after the 19th June will have below question shown below will be shown in HWS Question Block.

This will attach 1 minimum co-contribution charge of $200+GST per question block (implementation).

If their are 2 systems installed / 2 question blocks (implementations) the quantity is 2 with a minimum co-contribution cost of $400+GST.

If doing an STC only replacement choose the answer ‘No (Non-Scheme or STC Only)’ to avoid a co-payment.

HEAB HWS Installations

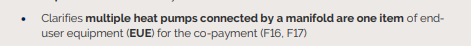

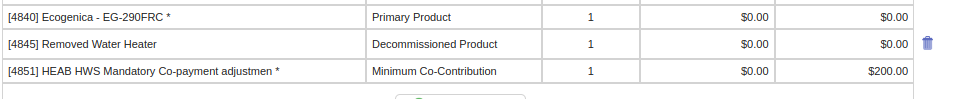

Prior versions of the ESS Rule did not required a Co-Payment for Activities F16 and F17.

For appointments with an activity date on/after the 19th June the below question has been added to HWS Question Block.

It has been confirmed that if their are multiple systems in manifold only 1 co-payment is required.

If 2 Question Blocks (2 implementations) of 2 non-manifold installs, a quantity of 2 Co-Contribution products will be added with value of $400+GST as shown below.

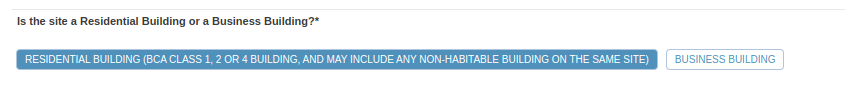

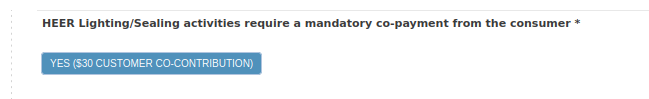

HEER Lighting and Sealing

Prior to this rule change, the co-payment adjustments was typically linked from an adjacent question like the one shown below.

This has now been moved to a dedicated question.

It has a single answer that attaches the existing ‘HEER Mandatory Co-payment adjustment’ to the Quote/Invoice as shown below.