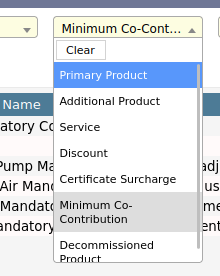

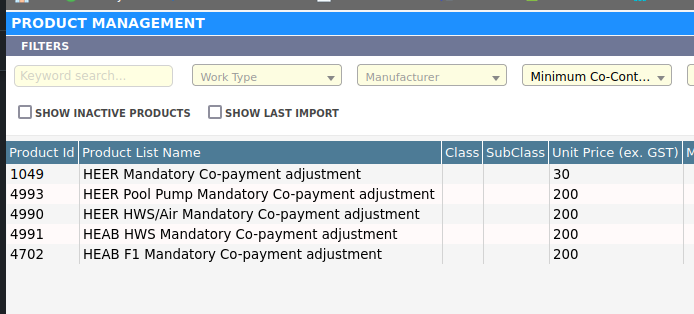

Minimum Co-Contribution products can be found in the Register using the Product Type filter and selecting the value ‘Minimum Co-Contribution’ from the list.

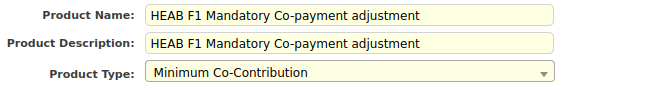

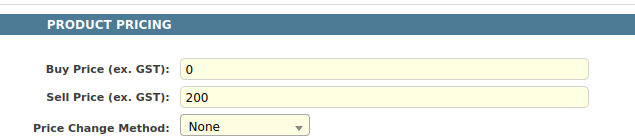

In the examples below, we use the RDC Activity F1 adjustment product.

This product has a Sell Price of $200+GST, which is the minimum a customer is required to pay for each implementation. If we have 3 of the above then customer’s minimum is (200*3) $600+GST.

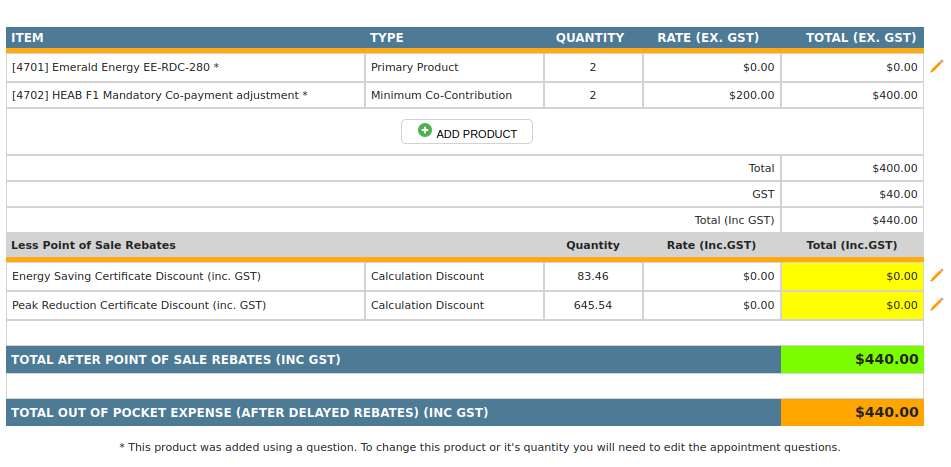

Our first example below assumes scheme products are missing a sell price. The Quote/Invoice would look as follows:

With 2 RDC products the customer must pay $400+GST. Without other customer costs or discounts the HEAB F1 Mandatory Co-payment adjustment has automatically calculated its unit price as $200+GST, for a total of $400+GST.

Note: Calculation discounts will only apply if scheme products have a sell-price.

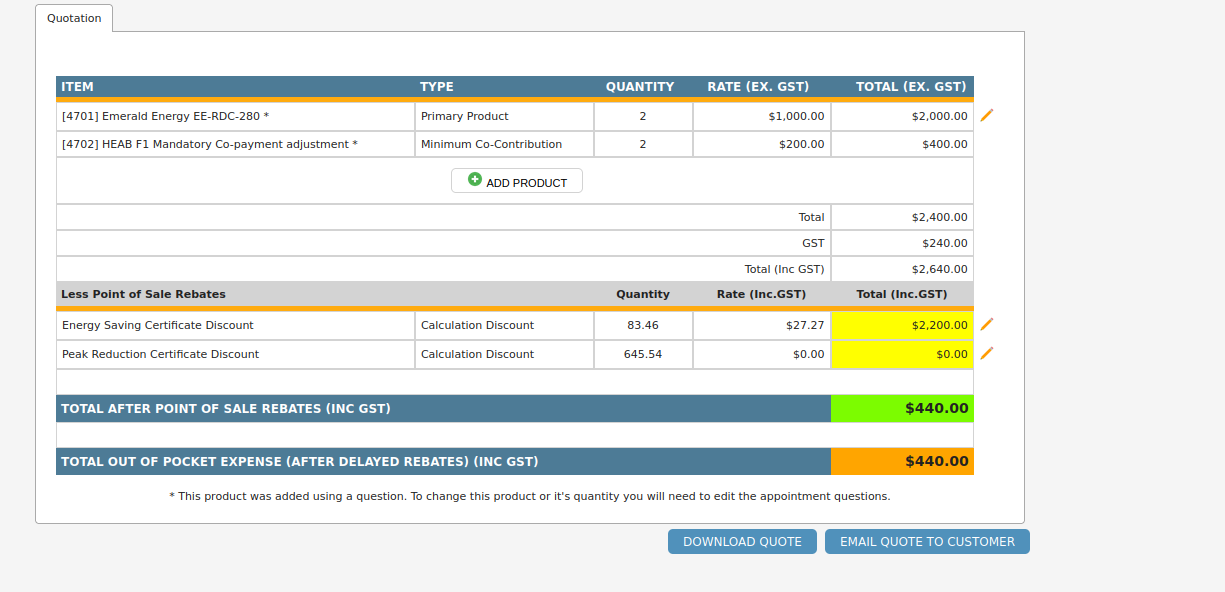

Our second example assumes a sell price on of $1,000+GST and a single Discount Type with Certificate Rate of $27.27 incGST. The Quote/Invoice would look as follows:

In this example the Certificate Discount totals $2,200 incGST and the cost of the Scheme Product is $2,200 incGST, so without the Co-Payment this job would be free.

The Co-Payment has rate $200+GST for total of $400.00+GST.

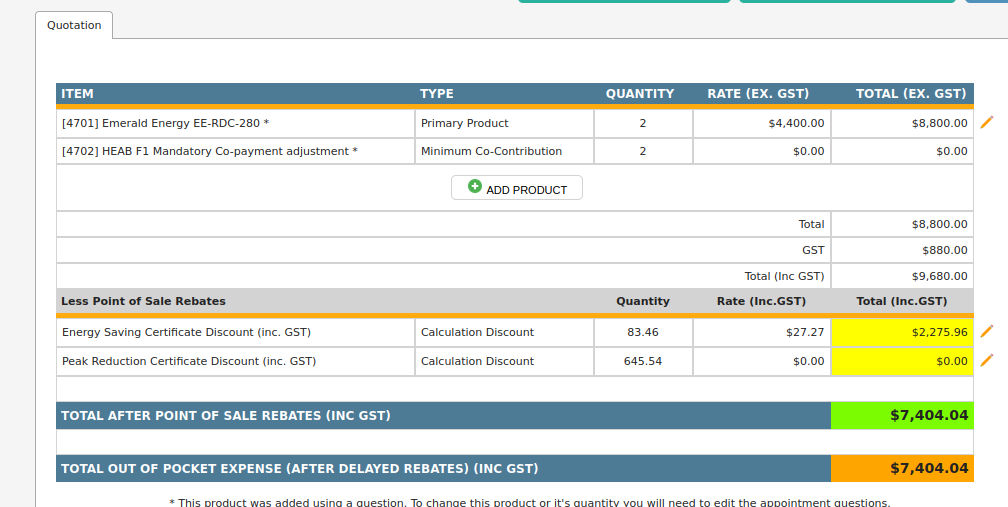

Our third example assumes a sell price on the RDC of $4000+GST per unit and single Discount Type with Certificate Rate of $27.27 incGST. The Quote/Invoice would look as follows:

The customer cost before discounts is $9,680 incGST the Certificate Discount is only $2,275.96 incGST leaving more than the minimum required of $440. The Co-Payment has adjusted itself down to zero as its not required.

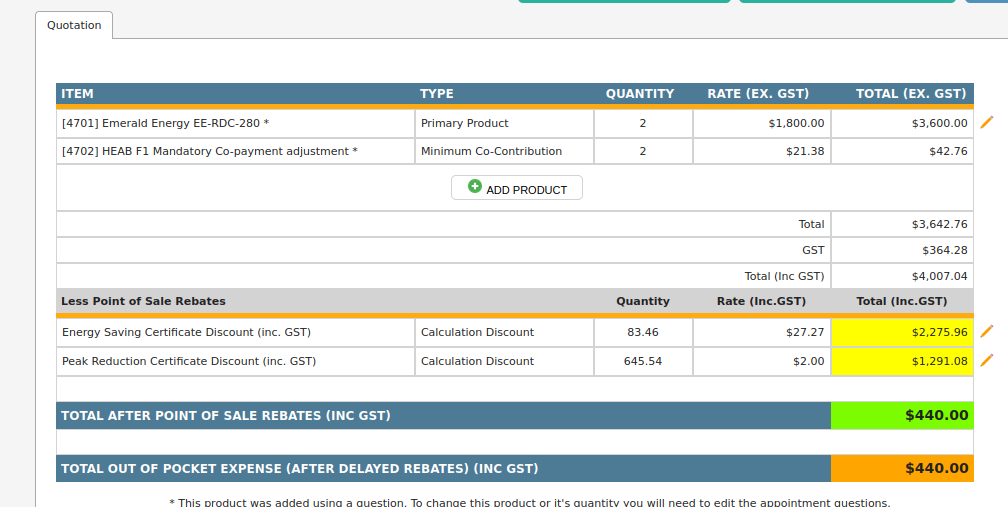

The fourth example assumes a sell price on the RDC of $1800+GST but with two Discount Types that when combined almost cover the customers cost. The Quote/Invoice would look as follows:

The total certificate discounts is $3,567.04 incGST. The customers product costs are only $3,960.00 incGST which leaves the deficit of ($3,960 - $3,567.04) - $440 = −$47.04 incGST or $42.76+GST.

The co-payment has been reduced to a unit rate of $21.28 = (42.76/2).

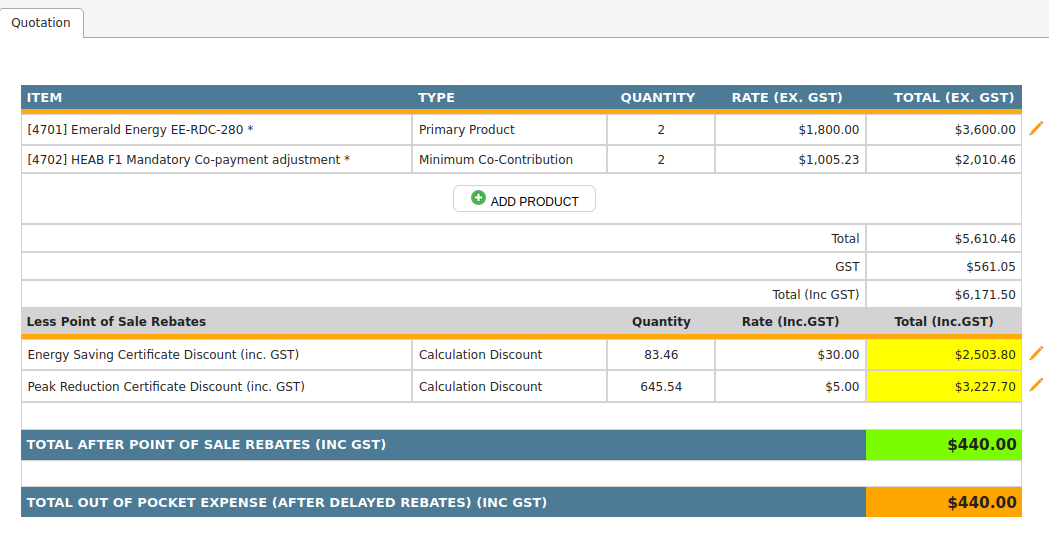

The fifth example assumes a sell price on the RDC of $1800+GST but with two Discount Types that when combined are more than the customers cost. The Quote/Invoice would look as follows:

The combined certificate discounts total of $5,731.5 incGST eclipses the customer cost of $3,960 incGST, leaving a deficit of ($3,960 - $5,731.5)-440 = -$2,211.50 incGST or $2,010.46+GST.

To ensure the customer pays the minimum co-payment amount, the co-payments rate has adjust to catch the extra discount. To adjust the co-payment back down towards $440 incGST, the certificate rate needs a reduction or an increase to the price of the scheme products is required.

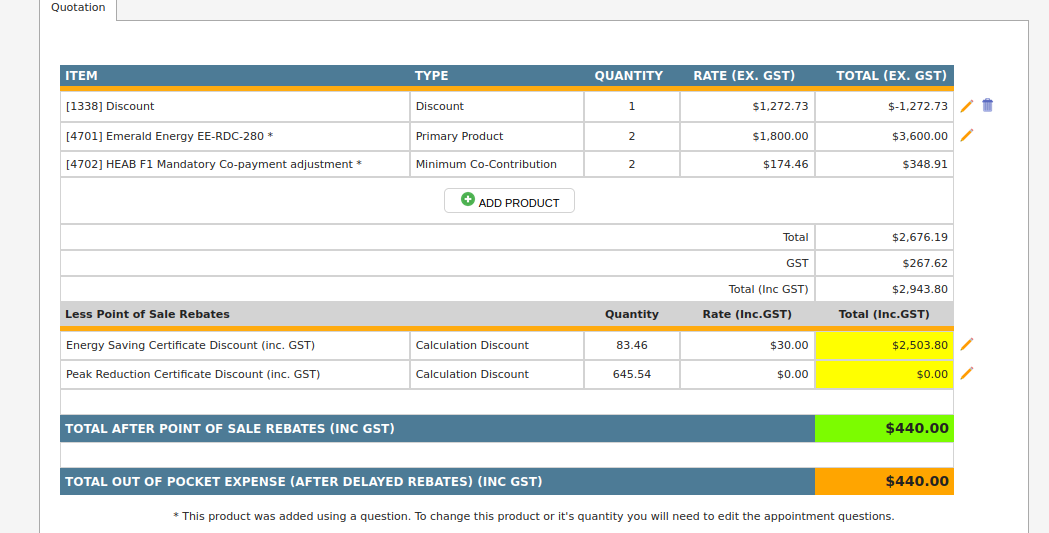

The Sixth example assumes a sell price on the RDC of $1,800+GST. A single Certificate Discount with rate of $30.00 incGST is applied, as well as an additional discount product. The Quote/Invoice would look as follows:

This calculated value includes the reduction from the additional Discount Product.

Customers Product Cost is $3,960.00 incGST.

Certificate Discount is $2,503.80 incGST.

Outstanding is $3,960-$2,503.80 = $1,456.20 incGST.

Additional Discount is $1,400.00 incGST.

Outstanding After Discount $1,456.20-$1,400.00 = $56.20 incGST.

Required Minimum is $440.00.

Co-Payment is $440-$56.20 = $383.80 incGST or $348.91+GST.

Co-Payments will adjust for both Certificate Discounts and Additional Discounts.

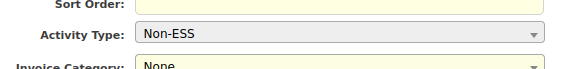

These last examples show how Co-Payment’s interact with Non-Scheme products.

A Non-Scheme product has the following properties:

Has an Activity that has discounts disabled.

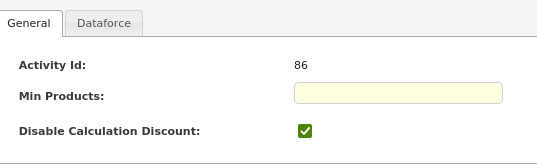

The product is not included in Minimum Contribution Calculation.

Each product in the product register has a setting called ‘Include in Minimum Contribution Calculation’. For Non-Scheme products this setting should be unchecked/off.

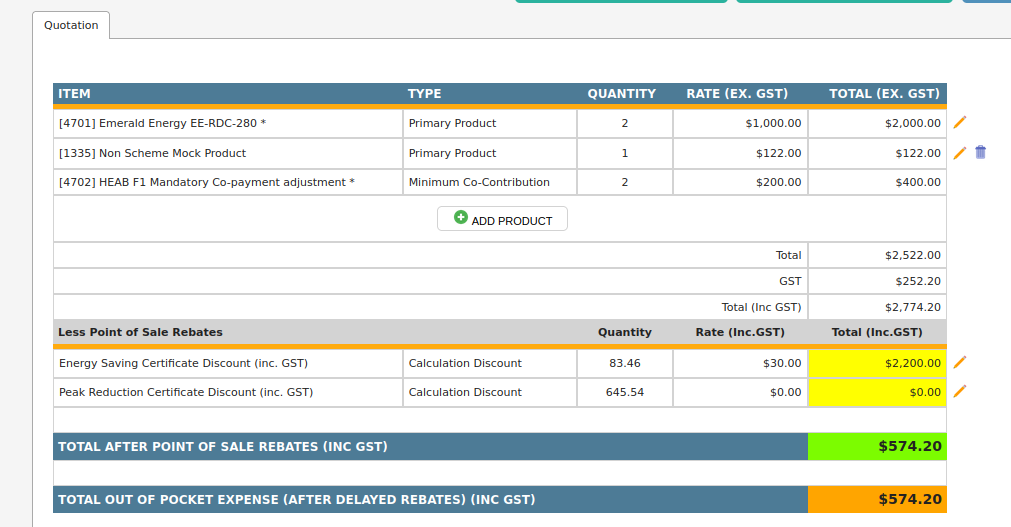

Returning to an earlier example if we assumes a sell price on the RDC of $1000+GST and a single Certificate Discount with rate of $30.00 incGST plus an additional non-scheme product, we will have a Quote/Invoice like below.

The customers outstanding is $574.20 incGST which is higher than the minimum of $440.00 incGST.

When Dataforce calculates the adjustment’s value it is ignoring the Non Scheme Product since the ‘Include in Minimum Contribution Calculation’ option is in not ticked/checked.

The customers outstanding balance comes from $440.00 incGST Co-Payment + $134.20 incGST from non-scheme product.

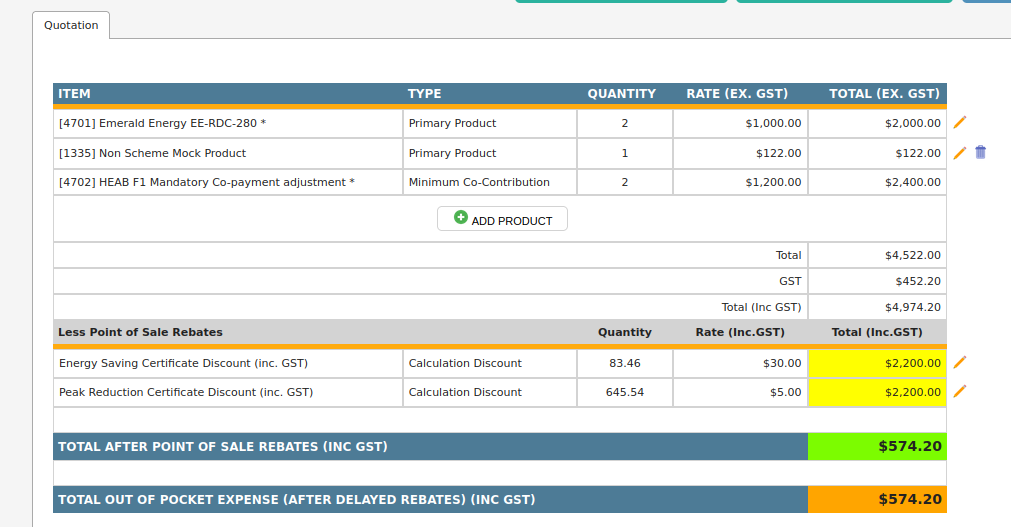

If another Discount Type is added to this above example e.g PRC is calculated with a rate of $5.00 incGST we have the following Quote/Invoice.

The customers balance remains $574.20 incGST, the Co-payment has adjusted itself up to catch the extra discount until the customers outstanding is $440.00 inc GST while still ignoring the Non-Scheme product.