Dataforce ASAP allows the creation of Recipient Created Tax Invoices, on behalf of a Field worker or Contracting Agent.

Appointments can be included in an invoice when they have been assigned an Invoice Eligibility Date

An Invoice with one to many invoice line items will aggregate for a set of products. Then multiplied buy a rate to arrive at a cost and are added together to reach an invoice total.

If an exception occurs an Invoice Variation can be created. It will be included in the next invoice with a custom quantity and rate.

An invoice has two partner datafiles called, ‘Contractor Activity Data’ which is the detailed view of the products and appointments. While the second datafile, ‘Activity Not Invoiced’, is a list of appointments that are not invoiced and not in the current invoice week.

To Issue an RCT Invoice, an operator will:

- Gather appointments into an invoice week by moving past/future appointments into the current week.

- Using the datafile ‘Contractor Activity Not Invoiced’ check for appointments that could be fixed and included.

- For each Field worker/Agent, review the contents of the ‘Contractor Activity Datafile’ against the invoice preview to ensure totals match.

- Finalize each Field Worker/agent RCTI to lockdown their appointments.

- Use the email function to send out an invoice and the two datafiles to the recipient.

- For internal use, download a combined copy of invoices in the PDF format and a combined contractor activity datafile.

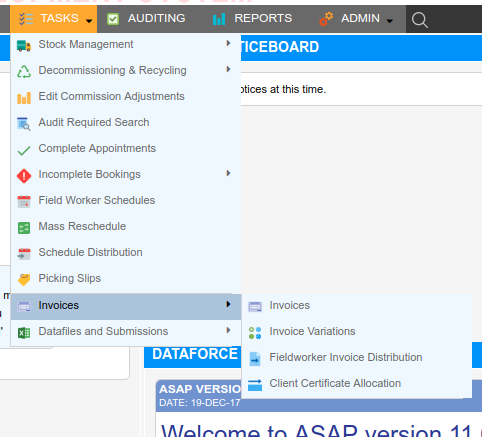

Invoicing is done via the Tasks > Invoices. The screens include:

- Invoices.

- Invoice Variations.

- Field worker Invoice Distribution.

- Client Certificate Allocation.

The majority of the invoice process is completed via the first screen.